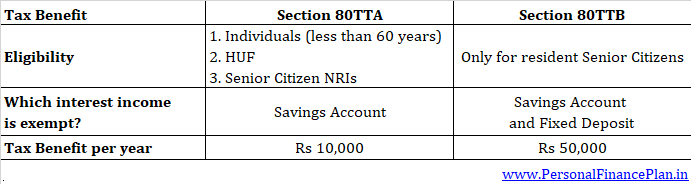

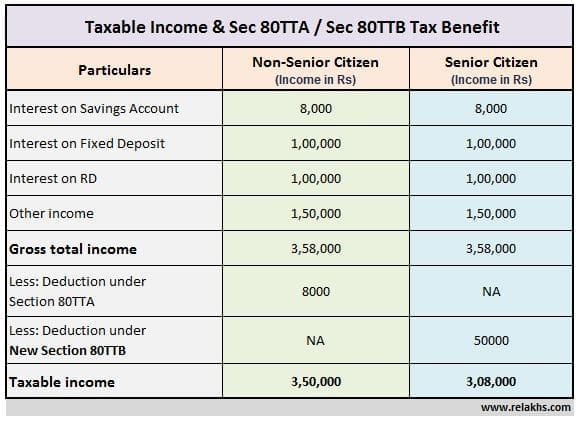

Section 80TTA Tax Benefits - NRI can claim 10,000 INR On interest of Saving Account | NRI Saving and In… | Savings and investment, Investment tips, Savings account

Pranab Bandyopadhyay on LinkedIn: Section 80TTA of the Income Tax Act for the Financial Year 2023-24