DRAFT DRAFT INTERPRETATION NOTE DATE: ACT : INCOME TAX ACT 58 OF 1962 SECTION : SECTIONS 49A to 49H SUBJECT : WITHHOLDING TAX O

Currency Rules National Treasury. Complex Web Of Currency Law 1.The foreign currency rules represent one of the most complex features of the Income Tax. - ppt download

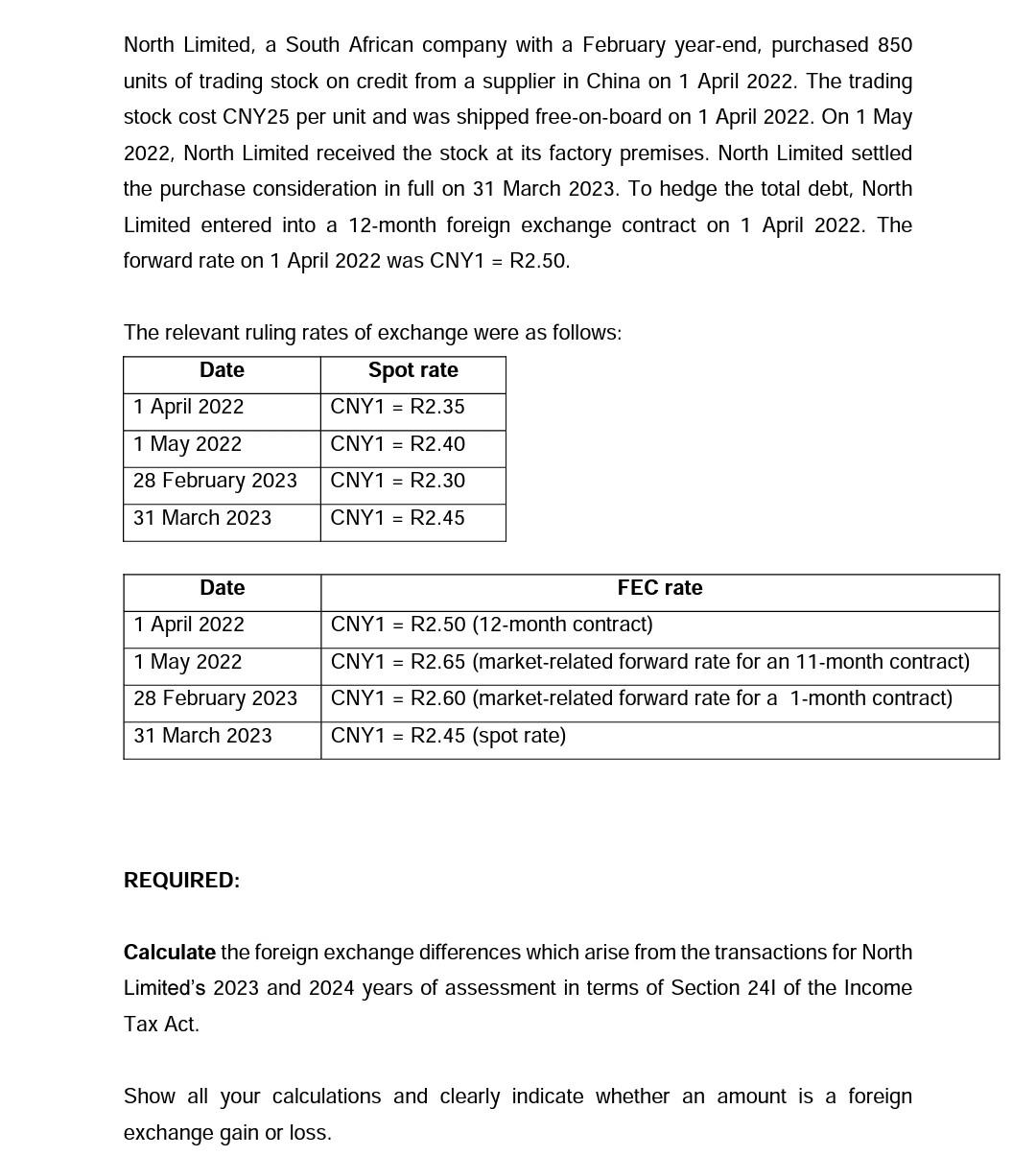

BINDING PRIVATE RULING: BPR 211 DATE: 10 December 2015 ACT : INCOME TAX ACT NO. 58 OF 1962 (the Act) SECTION : SECTIONS 24I AND

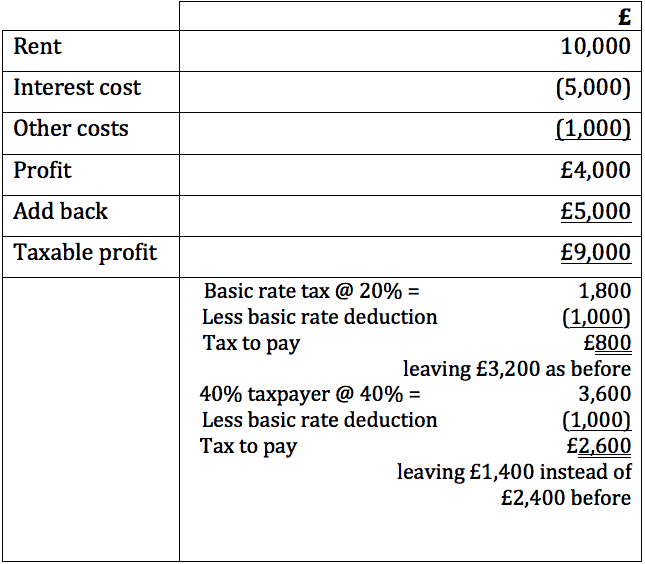

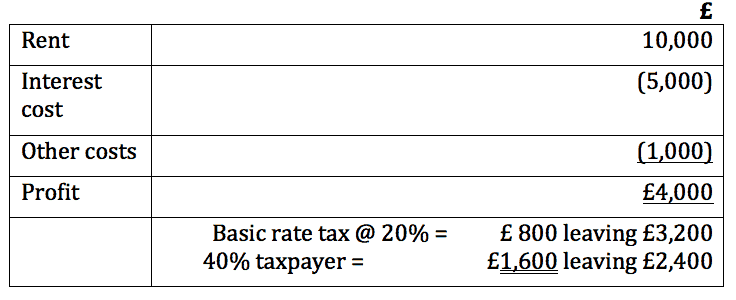

Currency Rules National Treasury. Complex Web Of Currency Law 1.The foreign currency rules represent one of the most complex features of the Income Tax. - ppt download

ACT : INCOME TAX ACT NO. 58 OF 1962 SECTION : SECTION 1(1) SUBJECT : RESIDENT: DEFINITION IN RELATION TO A NATURAL PERSON PHYSICAL PRESENCE TEST - PDF Free Download

Currency Rules National Treasury. Complex Web Of Currency Law 1.The foreign currency rules represent one of the most complex features of the Income Tax. - ppt download

Currency Rules National Treasury. Complex Web Of Currency Law 1.The foreign currency rules represent one of the most complex features of the Income Tax. - ppt download